Score

The score, ranging from 0 to 10, reflects the likelihood, within a 12-month span, of a company fulfilling its financial obligations.

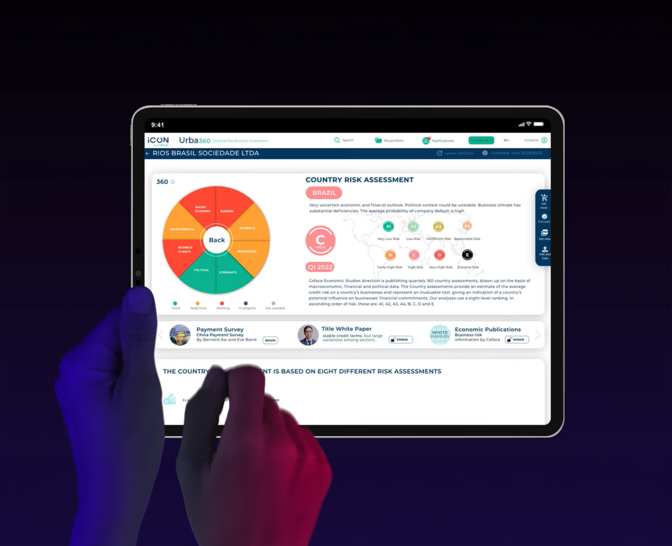

Gain a comprehensive understanding of your risk landscape with URBA 360

URBA360 is the ultimate platform for confident trade decisions. Access Coface’s unique data and expert insights on millions of companies in 190+ countries.

URBA360 merges precise data with expert opinions, enabling swift evaluation and monitoring of customers, suppliers, and partners in one view.

Our expertise is unique because based on over 75 years' experience in credit insurance:

Our Credit Insurer Insights are made available to our customers so they can make the best decisions for their business:

Coface’s Monitoring solution is your Real-Time business guardian.

Each time Coface detects a change on a monitored company of your portfolio, you are notified immediately:

> Track critical data, anticipate risks, and seize opportunities – all in real-time.

> Safeguard your business success with Coface Monitoring.

URBA360 is an intuitive and interactive web application that provides access to Coface's exclusive data for assessing commercial risk worldwide.

Accessible via the iCON by Coface platform, URBA360 enables users to explore indicators such as the Coface Score, @Credit Opinion and country or sector risk assessments.

Welcome to the future of informed decision-making! Explore the power of iCON by Coface.

Explore Coface API catalogue: integrated solutions for Trade Credit Insurance and business information.

Online services for customers and brokers

Business Information

Access the business insights you need to manage credit risks across your entire business-partner portfolio and make strategic decisions with confidence.

Customer Portal - CofaNet

Coface online platform for managing your trade receivables. Full monitoring of your risks. Direct access to all tools according to your contracts.

Broker Portal

Platform dedicated to brokers for monitoring your business and managing your customer portfolio (in all countries where legally available).

Innovative and digital solutions

Coface API Portal

Stop juggling between software applications. Explore our API Catalogue and integrated solutions for Business Information and Trade Credit Insurance.